With Groundfloor Lending

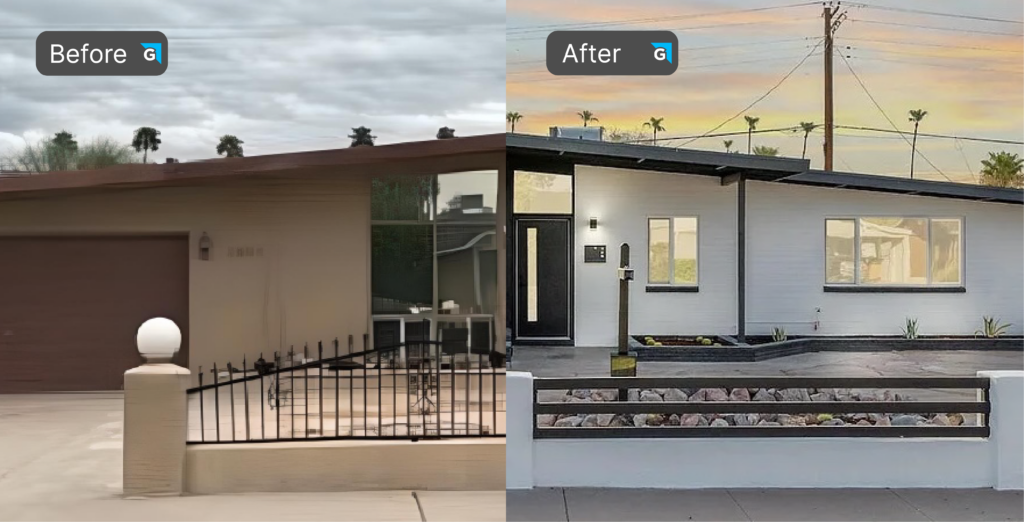

In many markets, house flipping continues to be a profitable strategy. Rising home values and sustained buyer demand mean there are still strong opportunities. With the right renovation approach and an experienced lender, investors can unlock strong returns in today’s market.

Fix & Flip Loans Frequently Asked Questions

A short-term loan that covers both the purchase and renovation of a property you plan to resell.

Many borrowers close in as little as 14 business days. Actual timelines vary depending on how quickly documents and inspections are completed.

Rates start around 9%, with terms from 6 to 18 months. Final rates are based on borrower experience, project scope, and ARV.

Draws are disbursed after each project phase is completed and verified by a third-party inspector.